FY 2019 Results - Improved Global Financial Performance

- Improved profitability driven by topline growth

- Strong position in ongoing industry digital transformation

ESI Group, Paris, France, (ISIN Code: FR0004110310, Symbol: ESI), releases its results for the financial year starting on February 1st, 2019 and ending on December 31st, 2019 (11 months), approved by the Board of Directors on March 19th, 2020. As decided at the Annual General Meeting of July 18th, 2019, the Group now closes the fiscal year on December 31st of each year, and therefore also presents its new twelve months proforma results.

Cristel de Rouvray, Chief Executive Officer of ESI Group, comments: “In FY’19 we increased growth while focusing on resource allocation to better control our costs. Our improved new fiscal year financial performance is the early result of a multi-year fundamental transformational effort that has comforted ESI’s position as the critical strategic partner for world class industrial leaders striving to accelerate their global digital transformation. Across key economic sectors, these leaders have maintained their commitment to pursue investing in our Hybrid Twin™ virtual prototyping solutions. This is the solid foundation of our confidence in our mid- and long-term business outlook. In the short-term, the disastrous coronavirus pandemic is expected to somewhat impact our H1. However, the resilience of our business model largely anchored on renewable and mission critical software licenses will help us manage full year risks. When industry recovers from this exceptional crisis, digital ways of working will be accelerated globally, fully dependent on ESI’s solutions to virtually anticipate and manage asset performance in-service, much beyond the traditional PLM certification target of the brand-new product.”

As a pioneer in virtual prototyping solutions and a key player in industrial digital transformation, ESI Group empowers manufacturers to navigate increasing complexity by replacing real tests and prototypes with highly accurate, predictive and representational virtual prototypes. ESI Group’s software solutions are built from decades of global expertise in physics of materials, essential to the creation of authentic virtual prototypes and to the anticipation of asset performance in-service. ESI’s customers are an enviable list of industry leaders worldwide, who benefit from enhanced innovation, competitiveness, performance and productivity thanks to ESI Group’s most innovative solutions.

Improved financial results

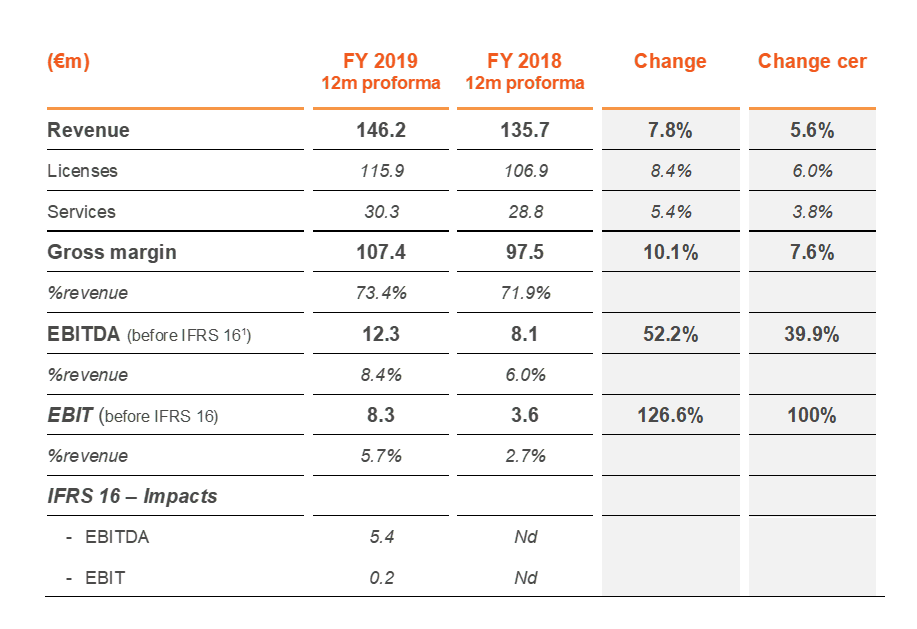

As a reminder, full year sales increased +7.8% to €146.2 million (+5.6% cer), driven by an 8.4% growth in software license activity yielding stronger business recurrence. This topline growth has a positive impact on financial performance as the Group maintained control of the costs.

Gross margin improvement

Gross margin rose to €107.4 million (up 10,1% improving by +1.5 points to 73.4% vs. 71.9%). This increase was driven by the rise in Licensing gross margin to 86.2% (vs. 84.5% in proforma 2018) and the increasing proportion of License sales in the revenue mix.

Lower growth in other operational costs

The Group maintained its efforts to control other operational expenses (+5.6%, +€5.2m) to support overall revenue increase and long-term development. Note that €1.5m of the €5.2m cost increase is linked to exchange rate (4.0% cer).

These operational expenses break down as follows:

- Sales & Marketing: remains nearly stable as a ratio of total sales, 30.3% (vs 31.0%).

- R&D costs: remains stable in absolute terms, reaching €31.7 million (vs. €31.3 million) after considering the Research Tax Credit (CIR) and capitalization of development costs. These expenses now represent 27.4% of Licensing revenue (vs. 29.2%).

- General & Administration: increased by €2.6m €23.2m vs. €20.6m, partly due to some exceptional expenses.

Improved profitability

EBITDA (before IFRS 16) increased to €12.3 million (vs. €8.1 million), now 8.4% of total sales (vs. 6.0%). EBIT (before IFRS 16) rose to €8.3 million (vs. €3.6 million), now 5.7% of total sales.

Cash position

The Group's available cash position rose to €20.2 million at December 31, 2019 (vs. €12.4m end of December 2018).

Financial debt reached €49.6 million (vs. €51.6 million) and Net debt decreased to €29.4 million (vs. €39.2 million). Gearing (net debt to equity) was 34.4% (vs. 57.7%).

At 31 December 2019, ESI Group held 6.3% of its capital in "treasury" shares.

Stronger business collaboration based on sharpened value proposition on a handful of priority industries and solutions

2019 was a year of dynamic business development worldwide, driven by engagements with global industry leaders, whether long-term customers or accounts that have recently surfaced as strategic partners.

These industrial actors are increasingly held to a result, an “outcome”: the service that their machine/car/part etc., offers, such as mobility, hours of maintenance-free flight or number of landing events, making them accountable for environmental and societal impact and for the experience “in service”. This entails being able to anticipate the way their industrial product or asset operates in numerous and uncertain use-conditions, thus shifting the standards of success to performance in use rather than standard product development efficacy.

ESI’s mission is to enable industrialists to commit to these outcomes, in a handful of major industries – Automotive & Ground Transportation, Aeronautics & Aerospace, Energy and Heavy Industry. The Group has now organized its value proposition around specific outcomes for our customers:

- Pre-certification: enables gains in performance and productivity. Thanks to predictive models and process automation industrialists can meet certification requirements and other validation needs without relying on real tests.

- Smart Manufacturing: establishes the right manufacturing processes to meet performance indicators for both industrial products (for instance reducing weight) and for associated processes (for example controlling distortions or reducing waste).

- Human Centric: allows customers to implement an operator-centric approach to ensure the efficiency of assembly and maintenance operations, while facilitating the early identification of human safety or related problems and ways to improve production processes.

- Pre-experience: this is the most advanced solution to support industrial leaders who are the furthest along in their transformation towards the “outcome economy”. ESI enables them, as well as their future customers and asset operators, to “experience” a product, component, subsystem or system as it ages as part of an operational in-service solution and under numerous use conditions.

For example:

- In Heavy Industry, ESI helps an American aluminum provider validate the manufacturability of new products made with new materials like composites and design with new processes. For this new customer neither physical tests nor traditional simulation tools could ensure they met their cost, speed and performance targets. The use of our Smart Manufacturing solutions helps this innovator accelerate and secure their new developments.

- In the Automotive Sector, the collaboration between ESI Group and Gestamp illustrates how innovation and added-value solutions are the foundation of a lasting partnership as they helped Gestamp propose differentiated manufacturing processes and parts to their OEM customers. For nearly 10 years, ESI has equipped Gestamp with pre-certification solutions to help them achieve cost optimization, weight reduction and performance increase, which is especially important amid new developments like Electric Vehicles.

- In Aeronautics, an Aerospace German Tier1 supplier was convinced by the Hybrid Twin™ concept developed by ESI experts, to solve a complex challenge: test and validate, in record-time, the design and validation of their next generation landing gears while pre-experiencing a multitude of landing scenarios (design, weather, etc.) that impact gear performance in-service.

This approach by Industry, and within it by outcome, and anchored on the resiliency of industry leaders deeply committed to ESI, will be the cornerstone of the Group's value proposition, business development efforts and effective resource allocation and cost control.

Insights on the 11-month FY2019

All financial indicators representing ESI Group 11-month FY19 cannot be compared with FY18 as the perimeter changed. The results of this 11-month format does not reflect the performance of the company globally due to the absence of January, one of the months with heavier business activity.

On 11-month 2019 basis:

- Revenue: €102.2 million

- Growth margin: €68.3 million with 66.9% margin

- EBITDA before IFRS 16: -€18.1 million

- EBIT before IFRS 16: -€22.0 million

- Net Result: -€20.9 million

Watch below the full recording of our FY19 Investor's Meeting