Half-year H1 2023 Revenue & Results

All information below concerns ‘constant perimeter’ , unless stated otherwise.

- Half-year revenue at €83.3m: +7.0% at constant exchange rate (cer), +5.0% YoY. Revenue growth within the upper range of the guidelines (5-7% cer).

- Half-year license revenue growing to €77.0 million: +10.8% cer, +8.8% YoY.

- Half-year Annual Recurring Revenue (ARR) reaching €80.2 million, a double-digit growth of +13.1% cer, +11.2% YoY.

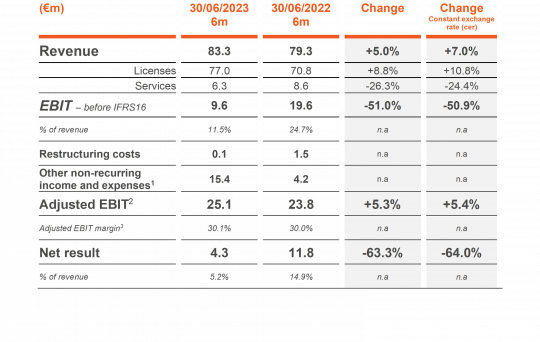

- Adjusted EBIT growing by 5.3%, from €23.8 million to €25.1 million YoY.

- A healthy financial situation with a positive net cash position

ESI Group, Rungis, France, (ISIN Code: FR0004110310, Symbol: ESI), today reveals its revenue and results for the first half of 2023 (period from January 1 to June 30), approved by the Board of Directors on September 12, 2023. Audit procedures performed by the Group auditors are finalized.

“For several consecutive quarters now, ESI Group has displayed exciting momentum. ESI Group has maintained robust growth, aligning with the goals outlined in our three-year plan, “OneESI 2024 – Focus to Grow”. Our strategic focus on our core software activities continued to deliver positive outcomes for the company. The sustained growth in our revenue, driven primarily by our annual recurring revenues, not only underscores the relevance of our solutions but also reflects the trust we've cultivated with our clients. In parallel, we delivered on all the actions and strategic focus to improve the financial health of our Group. The results are now visible. Our company is in a great position to tackle its short and long-term objectives. Finally, more than everything, I’m especially grateful for the dedication and enthusiasm of our teams, whose contributions have been instrumental in achieving these results “

Cristel de RouvrayChief Executive Officer of ESI Group

First-Half 2023 Keys Events

On April 17, ESI Group announced the sale of SYSTUS software and related engineering services. The sale of SYSTUS software and related activities to Framatome, an international player in the nuclear energy sector, illustrates the Group's continued execution of its strategic plan to focus on its core business. More info HERE.

On June 29, ESI Group announced the entry into exclusive negotiations between Keysight and ESI Group’s main shareholders to acquire a controlling block to be followed by the launching of a mandatory cash tender offer. More info HERE

Financial Highlights at Current Perimeter (audited)

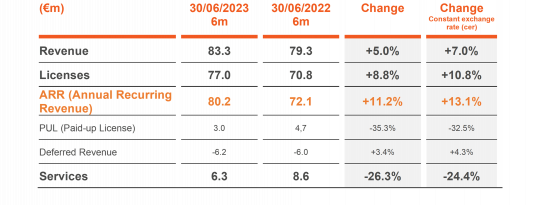

Financial Highlights at Constant Perimeter

Half-year revenue growth, in line with objectives, primarily driven by the recurring licensing activity

Half-year revenue increased by +7.0% cer (+5.0% YoY) to reach 83.3 million euros. This growth was driven by the licensing activity, which amounted to 77.0 million euros (representing approximately 92% of the half-year revenue, and a +10.8% cer growth, +8.8% YoY). Annual Recurring Revenue (licenses excluding paid-up licenses’ contracts and before deferred revenue) increased by 13.1% cer (+11.2% current rate) to 80.2 million euros. The revenue growth aligns with the company's announced objectives of +5-7%.

All geographic regions grew in the first half of 2023 at constant exchange rates: EMEA +8.3%, Asia +9.0%, and the Americas +2.7%. The variations of the Japanese Yen impacted the Asian performance when looking at the numbers at current exchange rates.

The revenue from the licensing business, in the first half of the year, was mainly driven by the core industries of the Group, especially the Automotive one.

This half-year performance relates to the first quarter as well as the second quarter. In Q2, the Group’s revenues increased by 6.4% cer to reach €22.5m (2.3% at current exchange rate – related predominantly to the impact of the Japanese Yen). The ARR grew by 12.3% cer (7.5% at current exchange rate) and the Services activity continued to decrease by -12.8% cer to €2.3m (-16.5% YoY).

Robust margins and increasing profitability in accordance with our objectives.

The adjusted EBIT stands at 25.1 million euros (+5.4% cer and +5.3% YoY). The adjusted EBIT margin remains stable at 30.1%, compared to 30.0% in the first half of 2022. The change in this indicator is primarily due to the robust increase of revenue reflected in gross margin, which is more than compensating a 2.7 million euro increase in costs, mainly related to a decrease in R&D capitalization compared to H1 FY22, resulting from phasing effects, as well as reduced subsidies for certain research projects in alignment with the "OneESI 2024: Focus to Grow" strategy.

The seasonality of the activity of ESI Group is to be considered here, as H1 captures a large part of the revenue due to historically favorable phasing of the sales, and, consequently, higher profit than the second half.

The company's results continue to align with the goals initially communicated by the Group.

A financially advantageous position

The cash and cash equivalents stand at 63.1 million euros, compared to 35.4 million euros at the end of June 2022, and gross financial debt decreased by - 7.5 million euros at 27.3 million euros compared to June 2022 (34.8 million euros).

As a result, ESI Group's net financial debt has decreased to -35.8 million euros (representing a net positive cash situation), compared to -0.6 million euros at the end of June 2022 and -7.3 million euros at the end of December 2022. This reduction was made possible by strong cash flow generation and includes part of the proceeds of SYSTUS divestiture. The gearing ratio (net financial debt/equity) continues to decline, reaching -33.0% compared to -0.7% in the first half of 2022 and -8.0% at the end of December 2022.

Upcoming event

- Third Quarter 2023 Revenue – November 10, 2023

[1] ARR: Annual Recurring Revenue - Total ESI Group Licenses revenue excluding PUL (Paid-up License) & deferred revenue.

[2] Constant perimeter: In order to factor for end of Russian activity (discontinued in 2022) as well as sale of assets in the field of fluid simulation ('CFD'), in July 2022, and the sale of its SYSTUS software and its related consulting activities in April 2023, corresponding revenue and costs have been excluded from “constant perimeter” indicators.

[3] Constant Exchange Rate” (“cer”): Restatement of the currency effect consists of calculating aggregates for the current year at the exchange rate of the prior year. Starting from January 2023, following to the upgrade of consolidation software, turnover of foreign subsidiaries is converted at the monthly average rate (formerly, turnover was converted at quarterly average rate). This change in modality had no material impact on the determination of revenue and costs.

[4] Other non-recurring income and expenses include mainly the net gain of SYSTUS divestiture less the accrual of costs incurred with the ongoing transaction related to the shareholding of the company and stock-based compensation expenses.

[5] Adjusted EBIT is a non-GAAP indicator based on EBIT (IFRS). Adjusted EBIT corresponds to EBIT before stock-based compensation expenses, restructuring charges, impairment and amortization of intangibles related to acquisition, IFRS 16 standard on leases and other non-recurring items described in note 5 above.

[6] Adjusted EBIT margin is calculated based on revenue.

[7] Net financial debt: Gross financial debt minus cash and cash equivalents. Negative financial debt means that cash and cash equivalent are greater than gross financial debt, hence, Group has a positive net cash position as of June 2023 and June 2022.

[8] Gearing: Net financial debt divided by equity (gearing is negative as the Group has a positive net cash position.