H1 2019 results

- Solid growth of the installed base and robustness of the business model

- Improved financial results

- Continued optimization of growth drivers

- Note: exceptional 11-month year in FY 2019; year ends on 12/31/2019

ESI Group, Paris, France, (ISIN code: FR0004110310, Symbol: ESI), today announced results for the first half of 2019[1].

[1] Exceptionally, 11-month financial year ending on 12/31/2019, following the approval of the AGM meeting on July 18, 2019; H1 reported here covers February to July of our traditional 12-month fiscal year.

[2] New IFRS 16 - Leases, applicable to financial years commencing on or after January 1, 2019

ESI Group confirms the strength and resilience of its business model and demonstrates its capacity for growth, as it continues to execute on its transformation and the focus plan orchestrated by Cristel de Rouvray, Group CEO since February 1, 2019.

A virtuous cycle: delivering growth and higher profitability

Revenue

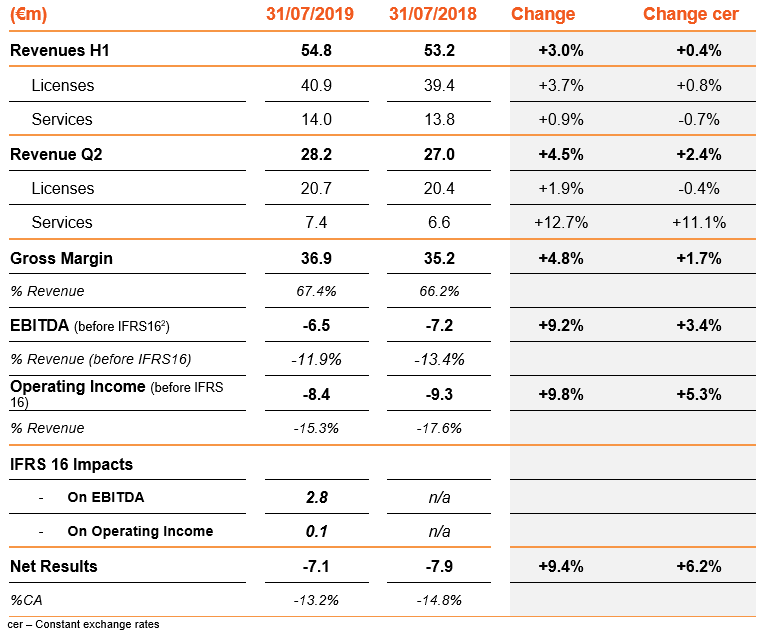

Group revenue rose 3% to €54.8 million in the first half, boosted by positive exchange rates (0.4% at constant currency). Quarterly sales were up in comparison with the same periods in 2018, with higher growth in license sales in Q1 and in services in Q2, reinforcing the fact that a longer-term perspective should be taken when reviewing our business model.

Growth was driven by licensing, up 3.7% (0.8% at constant currency) to €40.9 million and accounting for 74.5% of revenue in H1 2019. Services (Consulting, including studies for industry, advanced application research, R&D and training) were stable at €14.0 million (up 0.9% and -0.7% at constant currency).

ESI’s value proposition and ability to operate across the globe is a major asset in a market where key accounts are increasingly global. Six-month revenue picked up across all the geographies: the Americas (+ 9.4%), Asia (+ 2.6%) and EMEA (+ 0.9%) and in its main target industries: automotive (+5%) and aerospace (+11%), while energy contracted slightly (-3%).

Results

The focus plan aims to increase value creation by growing sales and expanding margins. Costs grew slower than half-year sales. At €36.9 million (up from €35.2 million) the gross margin at July 31, 2019 improved to 67.4% of sales (vs. 66.2%). EBITDA (without IFRS 16) and current operating income improved to -€6.5 million (from -€7.2 million) and to -€8.4 million (from -€9.3 million). Net income at the period end came out at € - 7.1 million (vs. € - 7.9 million).

Note that first half results (February to July) are negative, due to seasonality of license revenue.

Drivers of sustainable growth and outlook: focus on customer accounts by type

ESI Group business is highly recurrent, with a substantial proportion of the revenue generated by licensing repeatable from year to year. This builds long term relationships which are reinforced by complementary services.

The solidity of the model is reflected in ESI’s business with large OEMs, who are now at an advanced stage of their transformation towards eliminating physical tests and prototypes. Their needs are aligned with ESI’s value proposition, and they have considerable investment capacity. This alignment is especially evident in the automotive industry, where we note the continued success of our leading solution for crashworthiness and passenger safety and comfort, both designed to address the increasing complexity resulting from changes in passenger expectations and regulations.

Major customers are less visible in ESI’s first half revenues than in the full year. Accordingly, growth in the first half was also carried by other customers adopting a significant part of ESI Group offer. This target group has the potential to develop into key strategic accounts, giving a further boost to the highly recurrent nature of the revenue.

The strategic growth initiatives targeting the full range of customers include:

- solutions acknowledged as among the best on the market, backed by solid customer references. The successful IC.IDO ‘Human Centric’ virtual reality solution (to address the safety, efficiency and effectiveness of assembly processes) falls into this category. Recently, Safran Nacelles announced during the Paris Air Show that the solution had helped deliver 15% savings on their tooling budget, earning a return on investment in less than one year.

- our differentiating Hybrid Twin™ concept to guarantee the asset performance throughout its entire life. ESI Group is working with a major aeronautics company to help it design a diagnostic tool for the remaining service life of its aircraft, before planning maintenance operations.

These efforts fit into a longer-term approach based on innovation management to deliver continuous value for customers, all made possible by the combination of experience and commitment of the technical and managerial talent.

Now that we have integrated the additional costs linked to the investments, we made to spur our transformation, we see an expected uptick in our profitability. At this stage, the Group considers having the right resources and we are now focused on tuning the allocation of these resources to drive growth.

Important note: change in fiscal year closing

The annual general meeting on July 18, 2019 voted to approve a resolution to close the company's fiscal year on December 31 of each year. Accordingly, fiscal 2019 will run exceptionally for 11 months. To ensure the comparability of financial information, pro-forma financial statements will be published as of the announcement of 2019 revenue to facilitate projections of future performance.

Impact of application of IFRS16

New IFRS 16 applies to financial years commencing on or after January 1, 2019. It specifies how to recognize and measure lease assets and liabilities (property, plant and equipment – real estate and vehicles – and lease liabilities). The lease expense is now broken down between amortization and depreciation and the interest on the debt.